11 July 2005

Smiths Group today announced that it had successfully raised £660million under a multi-currency revolving credit facility for five years with the possible extension for a further two years at the option of the banks. The transaction was originally launched for £600million, but when oversubscribed, was increased to £660million. The facility was raised for general corporate purposes and will be partly drawn initially, replacing other short-term bank funding.

In addition, Smiths Group has secured funding of £70million from the European Investment Bank to underpin the groups research and development activities within Europe over a five year period.

These facilities provide Smiths with a solid medium term flexible finance package that underpins our business, and in particular, our commitment to research and development, said Alan Thomson, Financial Director. In addition, our financing obligations are now well spread over the next ten years through a variety of public market and bank debt, commented Peter Mason, Director, Corporate Finance.

The revolving credit facility was raised equally from eleven financial institutions each mandated as joint lead arrangers. The facility was led by Smiths Group Treasury, with coordination from Barclays Capital and BNP Paribas. Legal Advisers were Allen & Overy and Barclays Capital act as Facility Agents.

Smiths €300million Eurobonds mature on 18 July 2005 and will be repaid out of the groups general finance facilities.

ENDS

Related articles

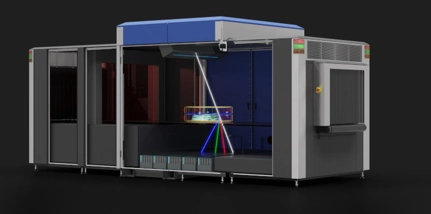

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more