22 September 2005

Highlights:

- Sales from continuing operations increased by 13% to exceed £3 billion

- All divisions contributed double-digit growth in headline profit

- Headline* PBT and EPS increased by 18%, to £413m and 54.3p

- On a statutory basis, PBT and EPS were £310m and 39.3p (2004: £300m and 38.0p)

- Cash generation below target, but expected to recover

- Outlook is for continued growth in 2006

- Annual dividend increased for 35th year, by 7.4% to 29.0p

* Before amortisation and impairment of goodwill and other intangible assets, and exceptional items

Commenting on the results, Keith Butler-Wheelhouse, Chief Executive said:

The increase in earnings came from a good performance across the company. We achieved underlying growth, improved our productivity and added valuable acquisitions. We are also seeing the benefit of recent higher investments in R&D. Looking ahead, the principal markets for our products are robust, and we have strengthened our competitive position within them. The plan for 2006 will follow a consistent formula: driving the top line ahead, controlling costs and finding value enhancing acquisitions. We are confident that we can deliver continued growth from across Smiths Group.

ENDS

Related articles

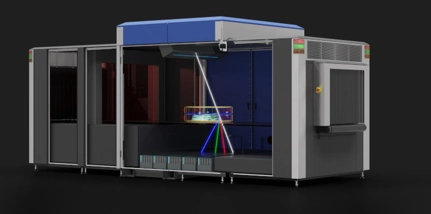

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more