3 February 2006

Smiths Group will announce its interim results on Wednesday, 15 March for the six months ended 31 January 2006. At the start of its close period, the company is providing the following trading update.

The company is currently achieving strong growth across its activities, and sales in the first half are expected to be close to 20% higher than a year ago. Underlying sales are expected to be ahead in all four divisions, with Medical additionally gaining from the inclusion of Medex for the full period.

Operating profit, after charging restructuring costs, is also expected to have improved by approximately 20%, sustaining margins of approximately 12% at this interim stage. As indicated at the AGM, the pattern of profit performance will vary by division. Double digit growth is expected in Specialty Engineering, Detection and Medical (the latter helped by the inclusion of Medex). In Aerospace, profit in this half is expected to be lower than last year, due to higher development costs expensed in the period.

Higher interest charges, due to the acquisition of Medex, will be partly offset by an improvement in pensions financing. Profit before tax and EPS are both expected to be close to 14% ahead of last year.

Net debt at 31 January is expected to be below £1 billion. The conversion of cash from operating profit should be above 80%, after capital expenditure and significantly higher development costs capitalised in this period.

Looking ahead, Smiths expects to sustain growth through the second half, with all four divisions contributing to a strong performance by the company in 2006.

ENDS

Related articles

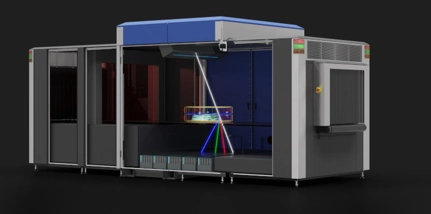

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more