19 March 2008

Smiths reports a 7% increase in sales and headline operating profit

Interim Results for the six months ended 2 February 2008

|

£m |

Headline* |

Statutory |

|||

|

Continuing activities |

2008 |

2007 |

growth |

2008 |

2007 |

|

Sales |

1,088 |

1,021 |

7% |

1,088 |

1,021 |

|

Operating profit |

158 |

148 |

7% |

170 |

149 |

|

Operating margin |

14.5% |

14.5% |

– |

15.6% |

14.6% |

|

Pre-tax profit |

159 |

134 |

19% |

165 |

136 |

|

Basic EPS (p) |

30.8p |

17.4p |

|

34.3p |

18.6p |

|

Interim dividend (pps) |

10.5p |

10.5p |

|

10.5p |

10.5p |

* In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Headline profit is before exceptional items (incl. impairment of assets and income and expenditure relating to John Crane litigation), amortisation of acquired intangible assets, profit/loss on disposal of businesses and financing gains/losses from currency hedging.

BUSINESS HIGHLIGHTS

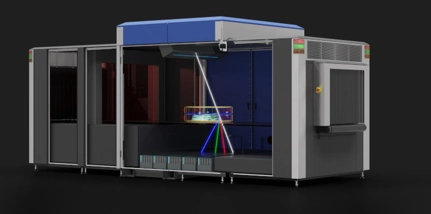

· Smiths Detection: Headline operating profit up 13% to £31m

o Strong sales of checkpoint explosive detection systems to UK and US customers

o Roll-out of the joint chemical agent detector (JCAD) to the US military

o Customs and border cargo screening continues to grow

· Smiths Medical: Headline operating profit flat at £61m

o 24-month performance improvement programme underway

o New product launches to be boosted with increased investment in R&D

· Smiths Specialty Engineering: Headline operating profit up 10% to £66m

o John Crane reports strong demand from petrochemical customers

o Margins to be enhanced through cost control and top line growth

o Smiths Interconnect has benefited from the roll-out of 4G communications in the US

Philip Bowman, Smiths Group Chief Executive, said:

“Smiths Specialty Engineering and Detection divisions delivered strong sales and profit growth in the first half, offsetting a flat performance from Medical. In Medical, we have initiated a detailed performance improvement programme and its delivery is a key priority.

“Since joining three months ago, I have begun a thorough review of operations and I find a business that has many strong positions in growing markets. There are significant opportunities to improve performance progressively over a two-year period. Smiths will focus on margin improvement, top line growth – especially in developing markets – and financial returns. There is also scope to grow the business through bolt-on acquisitions, such as Indufil and Fiberod announced today. Going forward, I believe there are clear opportunities to grow Smiths and improve returns for shareholders.”

ENDS

To view the full press release please click here

Website

From 09.00 (UK time) on 19 March 2008, the results presentation will be available from: (UK time) at www.smiths.com/results.

Webcast

A live webcast of the presentation to analysts will be available at www.smiths.com/results at 09.00 (UK time) on Wednesday 19 March. A recording of the webcast will be available later that day.

Related articles

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more