26 February 2009

Smiths Group plc ("Smiths") announced today that it has completed the raising of additional long-term debt capital from the issue of US$175m of Senior Notes ("Notes") in the US private placement market with a fixed 9 year maturity and a fixed coupon of 7.37%, the coupon having been set earlier in the year.

Smiths will use the proceeds from the Notes for general corporate purposes and to repay short-term borrowings drawn from committed bank facilities. These committed bank facilities are available to Smiths until June 2012 and will continue unchanged.

The Notes have been issued by Smiths and have been co-guaranteed by Smiths Group International Holdings Limited. The Notes will rank pari passu with all Smiths' existing unsecured indebtedness.

The Notes have been purchased by a single debt investor, Pricoa Capital Group, which is an existing investor in Smiths through its participation in the US$250m Senior Notes maturing in 2013.

John Langston, Finance Director of Smiths Group, said "We are delighted to have completed this debt financing at the same time as extending our long term relationship with a leader in the US private debt market. This transaction increases liquidity at the Group and significantly extends the maturity of our debt".

Marie Fioramonti, managing director, Pricoa Capital Group said, "Smiths Group is an investment-grade company that we know well and like. Its diversified range of businesses, both by geography and sector, provide underlying security and predictable cash flows, well-suited for a long-term private placement. We are delighted to be continuing our relationship with Smiths"

ENDS

Related articles

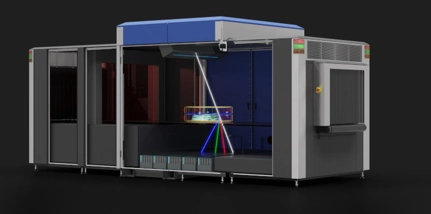

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more