25 March 2009

| Headline* | Statutory | |||||

|---|---|---|---|---|---|---|

| £m | 2009 | 2008 | Growth | Underlying# | 2009 | 2008 |

| Continuing activities | ||||||

| Sales | 1,292 | 1,088 | 19% | (3)% | 1,292 | 1,088 |

| Operating profit | 185 | 158 | 17% | (10)% | 160 | 170 |

| Operating margin | 14.3% | 14.5% | – | – | 12.4% | 15.6% |

| Pre-tax profit | 167 | 159 | 5% | (17)% | 135 | 165 |

| Basic EPS | 32.5p | 30.8p | 6% | 28.0p | 34.3p | |

| Free cash flow | 104 | 26 | ||||

| Dividend | 10.5p | 10.5p | 10.5p | 10.5p | ||

*In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Headline profit is before exceptional items, amortisation of acquired intangible assets, profit/loss on disposal of businesses and financing gains/losses from currency hedging. Free cash flow is described in the Financial review.

#Organic growth at constant currency.

Our reported results are ahead of last year driven by a strong organic performance from John Crane, the benefit of recent acquisitions, significantly improved cash generation and favourable exchange rates.

Clear opportunities remain to improve the business. Divisional restructuring is well underway to cut costs and enhance customer service while the rationalisation of the corporate HQ has already delivered £3m of cost savings. We have strengthened the Group portfolio and increased our exposure to faster growing markets through two acquisitions in China, subject to regulatory approvals.

The business environment has changed dramatically since last September when we announced our preliminary results. Smiths Group has not been immune to the economic challenges but our half-year performance demonstrates a resilience that augurs well for the longer term in markets with inherently strong secular growth prospects. Our focus remains to deliver our cost saving initiatives, generate cash and deliver long-term value for shareholders. A solid balance sheet underpins these plans. Absent further deterioration in world economies and assuming current exchange rates, we remain on track to deliver full year results in line with expectations.

Philip Bowman

Chief Executive

Smiths Group plc

Highlights

Key developments*

- Divisional restructuring programmes underway to reduce costs and improve customer service

- Rationalisation of the corporate HQ completed and greater divisional focus on delivering returns – total restructuring savings to date of £8m

Upgrade of business systems including ERP for Detection, John Crane and Medical on track - Underlying increase in Group R&D investment of 11% to £49m (reported increase of 29%)

- Extended our product portfolio and presence through two acquisitions, subject to regulatory approvals

- US$175m of additional long-term debt capital raised in February to extend our maturity profile

- Strong free cash flow generation

Business highlights*

Smiths Detection: Reported sales up 5%; underlying sales down 11%

As previously guided, revenue was distorted by variable order flow – particularly in ports and borders

Strong sales of airport equipment to US and good military growth with orders for JCAD

Margins adversely affected by currency transaction (£5m) and adverse cost absorption due to reduced volumes

John Crane: Reported sales up 39%; underlying sales up 6%

Growth driven by ongoing demand from the oil and gas sector and robust aftermarket

Restructuring initiatives delivered £3m savings

Upstream energy services business created with CDI and Fiberod

Smiths Medical: Reported sales up 16%; underlying sales down 3%

Single-use consumables proving more robust than hardware

Operational improvements have reduced customer backorders to a five year low

Decision to exit diabetes business informed by SKU and customer profitability review

Smiths Interconnect: Reported sales up 25%; underlying sales down 2%

Several long-term military programmes have delivered revenue growth

Offset by lower sales to wireless operators following a large contract last year

First half margins constrained by restructuring costs

Flex-Tek: Reported sales up 12%; underlying sales down 11%

Performance affected by deepening recession in US housing and household appliances although market share increased

Continued growth in sales of components to the aircraft industry

Rationalisation programme and other cost initiatives helping preserve margins

*Underlying figures are at constant currency and exclude the impact of acquisitions and disposals

To view the full press release please click here

Website

From 08.30 (UK time) on 25 March 2009, the results presentation will be available from: (UK time) at www.smiths.com/results.

Webcast

A live webcast of the presentation to analysts will be available at www.smiths.com/results at 09.00 (UK time) on Wednesday 25 March. A recording of the webcast will be available later that day.

Related articles

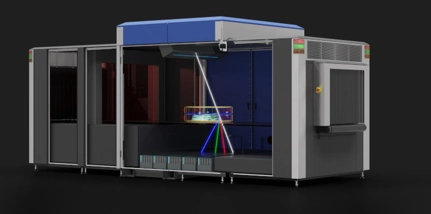

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more