28 September 2010

| £m | Headline* | Statutory | ||||

|---|---|---|---|---|---|---|

| Continuing activities | 2010 | 2009 | Growth | Underlying# | 2010 | 2009 |

| Sales | 2,770 | 2,665 | 4% | 0% | 2,770 | 2,665 |

| Operating profit | 492 | 418 | 18% | 14% | 436 | 429 |

| Operating margin | 17.8% | 15.7% | - | - | 15.7% | 16.1% |

| Pre-tax profit | 435 | 371 | 17% | 14% | 373 | 371 |

| Basic EPS | 84.6p | 72.4p | 17% | 75.3p | 70.8p | |

| Free cash flow | 331 | 256 | 29% | |||

| Dividend | 34.0p | 34.0p | 34.0p | 34.0p | ||

| Return on capital employed | 16.6% | 14.7% | ||||

*In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Headline profit is before exceptional items, amortisation of acquired intangible assets, profit/loss on disposal of businesses, costs of acquisitions and financing gains/losses from currency hedging. Free cash-flow and return on capital employed are described in the Financial review.

#Organic growth at constant currency.

Highlights

- Strong financial performance – headline operating profit up 18% (14% underlying)

- Headline operating margin up 210 basis points to 17.8%

- Margins ahead in all divisions driven by operational efficiency initiatives

- Restructuring programme generated savings of £24m; £41m to date and ahead of plan

- Procurement initiatives delivered savings of £11m; £20m to date

- Company funded R&D increased by 5% to £93m

- Cash conversion grew to 115% (2009: 104%) of headline operating profit

- Free cash-flow increased 29% (£75m) to £331m

“We have delivered a strong performance in a tough economic environment. Our focus on operational improvement and restructuring continues to deliver significantly enhanced margins, which are now the highest for ten years. Headline operating profit is up strongly, driven primarily by organic growth across all divisions, as well as the benefit of recent acquisitions and favourable exchange rates. Sustained delivery on cash conversion supported a £75m increase in free cashflow to £331m. Return on capital employed increased 190 basis points to 16.6%.

“Looking ahead, our priority is to deliver the additional cost savings due from our restructuring and other initiatives. Cash conversion and improving returns continue firmly in our sights, as we invest in the drivers of future growth including new product development, marketing, an enhanced sales infrastructure and targeted acquisitions. The uncertain economic outlook and constraints on government spending will continue to affect sales growth. However, we will concentrate on those opportunities within our control to improve performance further and enhance margins.”

Philip Bowman

Chief Executive

Smiths Group plc

Divisional highlights*

Smiths Detection: Sales up 13% and headline operating profit up 40%; margin up to 15.7%

- Double digit sales growth driven by ports and borders and transportation markets

- Margins improved by 310 basis points to 15.7% with increased volumes and better overhead recovery

- Military business continues to benefit from long-term programmes such as JCAD

- Well-positioned for growth although stretched government finances may affect the order profile

John Crane: Sales down 5% and headline operating profit up 9%; margin up to 20.7%

- Margins improved by 260 basis points to 20.7%, benefiting from operational efficiency initiatives

- Restructuring initiatives delivered £12m savings in the year, raising the total to date to £19m

- Sales declined as customers reduced investment in OEM equipment

- Improving order book has delivered sales growth in the second half on the prior period

Smiths Medical: Sales flat and headline operating profit up 10%; margin up to 21.5%

- Excluding diabetes, sales grew 2%; hardware sales up 2% and disposable items up 3%

- Cost management and restructuring initiatives have expanded margins 180 basis points to 21.5%

- Portfolio profitability review has reduced complexity and is delivering price and margin benefits

- Supply chain and customer service improved by performance initiatives

Smiths Interconnect: Sales down 3% and headline operating profit up 3%; margin up to 18.2%

- Margins improved by 80 basis points through restructuring, manufacturing efficiencies and procurement savings

- Military and aerospace markets have returned to growth while wireless telecoms and other markets remain weak

- Launch of new broadband antenna for commercial aircraft helped second half sales

- Integration of Interconnect Devices, Inc. on track: expanding product offering and increasing exposure to China

Flex-Tek: Sales down 6% and headline operating profit up 6%; margin up to 11.1%

- Continued site rationalisation and tight cost control helped increase margins by 120 basis points

- US residential construction and household appliance markets improved in the second half but remain fragile

- Sales of components to the aerospace markets continued to be weak

*Figures are at constant currency and exclude the impact of acquisitions and disposals

ENDS

You can click here to view the full press release.

The presentation slides and a live webcast of the presentation to analysts is available at www.smiths.com/results.

Related articles

Smiths Group appoints Kini Pathmanathan as Head of Smiths Excellence & Sustainability

Find out more

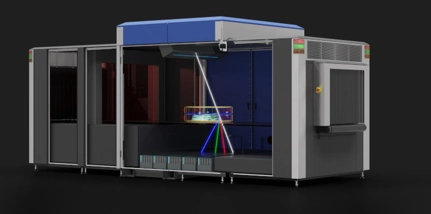

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more