17 September 2014

| Headline* | Statutory† | |||||

|---|---|---|---|---|---|---|

| 2014 £m |

2013 £m |

Growth | Underlying# | 2014 £m |

2013 £m |

|

| Revenue | 2,952 | 3,109 | (5)% | 0% | 2,952 | 3,109 |

| Operating profit | 504 | 560 | (10)% | (6)% | 378 | 486 |

| Operating margin | 17.1% | 18.0% | (90) bps | – | 12.8% | 15.7% |

| Pre-tax profit | 445 | 498 | (11)% | (6)% | 302 | 396 |

| Basic EPS | 81.8p | 92.7p | (12)% | 59.0p | 80.1p | |

| Free cash flow | 143 | 237 | ||||

| Dividend | 40.25p | 39.5p | 2% | 40.25p | 39.5p | |

| Return on capital employed | 15.7% | 16.6% | (90) bps | |||

*In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Headline profit is before exceptional items, amortisation and impairment of acquired intangible assets, pension charges and financing gains/losses from currency hedging. Free cash-flow and return on capital employed are described in the Financial review.

†The statutory figures for 2013 have been restated for IAS 19 (revised 2011).

#Organic growth adjusting for foreign exchange translation.

Highlights

- Commercial market gains but challenging healthcare and homeland security markets

- John Crane, Smiths Interconnect and Flex-Tek increased underlying revenue and margins

- Smiths Medical returned to growth in H2 with improvement in infusion pumps

- Smiths Detection margins under pressure with tough trading and additional charges

- Fuel for Growth restructuring programme delivered £10m of savings

- FX impact of £43m on operating profit: translation of £27m and transaction of £16m

- Company-funded investment in new products up 5% underlying to £109m

- Headline operating cash conversion at 97%; dividend up 2%

“Underlying revenue and margins rose in John Crane, Smiths Interconnect and Flex-Tek but were offset by declines in Smiths Medical and Smiths Detection. Smiths Medical saw revenue grow in the second half driven by good growth in its infusion franchise. Smiths Detection’s performance was disappointing with a difficult trading environment and one-off charges of £30m in the year. Our overall results were significantly reduced by foreign exchange headwinds.

“Our strategy remains to accelerate medium-term growth and reposition the business through consistent investment in product innovation, sales effectiveness, and expansion in higher growth markets. This investment is funded by our Fuel for Growth programme, scheduled to generate £60m of annual savings by 2017 with initiatives underway across all divisions.

“Looking ahead, we remain well-placed to benefit from growth in energy demand, the need for new fuel-efficient aircraft, increased US residential construction and investment in wireless networks. However, we remain cautious about sectors such as healthcare, homeland security and defence, which are subject to government funding constraints, although there are signs that the defence market is beginning to stabilise.”

Philip Bowman

Chief Executive

Divisional highlights*

| Headline operating profit margin | Headline return on capital employed | ||||||

|---|---|---|---|---|---|---|---|

| % of Group revenue | Underlying revenue growth* | Underlying headline profit growth* | 2014 | 2013 | 2014 | 2013 | |

| John Crane | 32% | 2% | 8% | 24.9% | 23.4% | 26.7% | 25.7% |

| Smiths Medical | 27% | (1)% | (12)% | 19.8% | 22.2% | 14.5% | 16.6% |

| Smiths Detection | 17% | (5)% | (57)% | 4.8% | 10.4% | 3.9% | 8.8% |

| Smiths Interconnect | 15% | 1% | 9% | 16.0% | 14.9% | 13.7% | 12.4% |

| Flex-Tek | 9% | 3% | 14% | 18.9% | 17.1% | 34.0% | 30.8% |

| Group | 100% | 0% | (6)% | 17.1% | 18.0% | 15.7% | 16.6% |

*All figures are on a headline basis. Revenue and profit growth are at constant currency and exclude the impact of acquisitions and disposals

John Crane

- Revenue up 2% driven by both original equipment and aftermarket sales, particularly in oil and gas

- Excluding upstream energy services, revenue grew 4% on an underlying basis

- Margins improved 150 basis points to 24.9%, a new high; while new product investment rose 13%

- Well-positioned for future growth supported by a record order book

Smiths Medical

- Revenue down 1% driven by price pressure – particularly affecting consumables; return to revenue growth in H2

- Developed markets continued to be hit by constrained hospital budgets, slow procedure rates and adverse pricing

- Margins fell 240 basis points driven by adverse FX transaction, price pressure and US medical device tax

- Developed markets remain challenging; cost savings will largely be reinvested for growth initiatives

Smiths Detection

- Revenue down 5% against a strong comparator – weakness in transportation, ports & borders and military

- Margins reduced by working capital adjustments, adverse price/mix, additional programme costs and other charges

- New leadership is restructuring business and improving programme delivery capabilities

- Order book in line with last year; margins should improve against a weak comparator

Smiths Interconnect

- Revenue up 1% with a return to growth in H2 on strong demand from microwave customers

- Margins up 110 basis points reflecting productivity gains and better volumes

- Underlying investment in new products increased 5% while emerging market sales grew 15%

- Commercial markets are expected to see continued growth with defence stabilising

Flex-Tek

- Revenue up 3% driven primarily by US residential construction and heat solutions

- Improved volumes, mix and pricing helped push profit up 14% and margins up 180 basis points

- Aerospace and US construction sectors expected to support continued sales growth

- Margins geared to volume improvements across Flex-Tek’s end markets

To view the full press release please click here

Statutory reporting

Statutory reporting takes account of all items excluded from headline performance. On a statutory basis, pre-tax profit from continuing operations was £302m (2013: restated £396m) and earnings per share were 59.0p (2013: restated 80.1p).

The items excluded from headline performance totalled £143m and comprised:

- amortisation and impairment of acquired intangible assets of £39m (2013: £47m);

- £54m in connection with John Crane, Inc. asbestos litigation (2013: £17m);

- £11m associated with Titeflex Corporation litigation (2013: £8m);

- £29m of exceptional restructuring costs (2013: £8m);

- £9m for retirement benefit finance charge (2013: restated charge of £23m);

- £6m of legacy retirement benefit administration costs (2013: restated £7m);

- £3m profit on disposal of property and businesses (2013: £6m);

- £1m cost of acquisitions, disposals and aborted transactions (2013: £3m);

- £2m gain on legal settlements and diabetes royalty payments (2013: £1m);

- £2m gain on reassessed contingent consideration provided on acquisitions (2013: £2m); and

- £1m of financing losses (2013: £2m).

In the period to 31 January 2013, in addition to the above, £1m gain on changes to pension plans and £1m of financing losses were also excluded from headline performance.

This document contains certain statements that are forward-looking statements. They appear in a number of places throughout this document and include statements regarding our intentions, beliefs or current expectations and those of our officers, directors and employees concerning, amongst other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the business we operate. By their nature, these statements involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. The forward-looking statements reflect knowledge and information available at the date of preparation of this document and, unless otherwise required by applicable law, the Company undertakes no obligation to update or revise these forward-looking statements. Nothing in this document should be construed as a profit forecast. The Company and its directors accept no liability to third parties in respect of this document save as would arise under English law.

This press release contains brands that are trademarks and are registered and/or otherwise protected in accordance with applicable law.

Presentation

The presentation slides and a live webcast of the presentation to analysts are available at www.smiths.com/results at 09.00 (UK time) on Wednesday 17 September. A recording of the webcast is available later that day. A live audio broadcast of the presentation is also available by dialling (no access code required):

UK toll free: 0808 237 0062

International: +44 (0)20 3426 2890

US/Canada toll free: 1 877 841 4558

An audio replay is available for seven days on the following numbers (access PIN 649759#):

UK toll free: 0808 237 0026

International: +44 (0)20 3426 2807

US/Canada toll free: 1 866 535 8030

Photography

Original high-resolution photography and broadcast quality video is available to the media from the media contacts above or from http://www.smiths.com/images.aspx.

Related articles

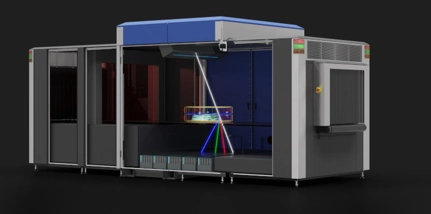

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more