18 November 2014

Smiths Group Chairman, Sir George Buckley, will refer to the following trading statement at the Company’s Annual General Meeting in London today.

Expectations for the year remain in line with the outlook given at the full year results. Foreign exchange translation and transaction are expected to have an adverse impact of c.3% on the Group’s first half headline operating profit. However, this headwind is expected to reverse during the second half if current exchange rates are maintained. More generally, as previously guided, the Group’s underlying performance will be weighted towards the second half.

In the three months to 1 November 2014, underlying revenue and headline operating profit at Smiths Group fell as expected against the first quarter last year as growth in Smiths Medical was more than offset by declines in Smiths Detection and Smiths Interconnect. John Crane revenues and headline operating profit were broadly similar to last year’s first quarter. Headline operating cash conversion was strong for the first quarter at 94%.

John Crane’s aftermarket and first-fit rotating equipment business delivered underlying growth in revenue and operating profit in the quarter. This was offset by year-on-year declines in the upstream energy services business resulting in overall John Crane revenue and profit at a similar level to the same period last year. While this upstream business has now stabilised on a consecutive monthly basis, first quarter performance is still set against a relatively stronger prior period. The John Crane order book is expected to deliver revenue growth, although as guided at the year end, the growth rate will be below the medium-term operating range in the first half because of the headwinds in the upstream business and some manufacturing constraints affecting the aftermarket and first-fit rotating equipment business. These factors should be resolved by the end of the first half and full year margins are expected to be at the upper end of guidance. While the order book remains at near record levels, we continue to monitor the trading environment closely given wider concerns over the outlook for oil and gas capex and lower oil prices.

Smiths Medical saw a further improvement in underlying revenue growth driven by strong demand for infusion pumps and improving performance in its vital care business, particularly its respiratory and tracheostomy products. Headline operating profit also increased with the higher volumes and the benefit of cost saving initiatives despite the continued headwind from foreign exchange transaction impacts. We expect to see continued growth in revenue and headline operating profit in the first half and full year results.

Smiths Detection still faces challenging trading conditions across most of its markets reflecting continued constraints on government spending. These resulted in lower underlying revenue and headline operating profit in the first quarter. Our key priority remains to reduce costs through ongoing site rationalisation, value engineering and other productivity initiatives in order to improve profitability and combat price pressure. As previously guided, the outlook for the first half is for lower underlying revenues and margins while the full year margins are expected to improve against a weak comparator affected by one-off costs.

Smiths Interconnect saw declines in revenue and headline operating profit at constant currencies as the year started more slowly than expected. This reflects some spending delays by wireless telecoms customers, the timing of certain orders for test equipment with revenue benefiting the prior year and continued softness in some end markets, particularly defence. First half revenues and profitability are budgeted to be below last year. However, the second half should see some recovery against the first half reflecting normal seasonality in certain markets and the timing of benefits from growth investments.

Flex-Tek reported a modest increase in underlying revenue. Sales of automotive components drove growth in Fluid Management while Heat Solutions benefited from increased sales of specialty heating elements. The outlook for the full year remains positive and in line with previous guidance.

At 1 November, net debt was £817m, slightly increased from the £804m at 31 July 2014.

This press release contains certain forward-looking statements with respect to the operations, performance and financial condition of the Group. By their nature, these statements involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. The forward-looking statements reflect knowledge and information available at the date of preparation of the press release and the Company undertakes no obligation to update these forward-looking statements. Nothing in this press release should be construed as a profit forecast.

Related articles

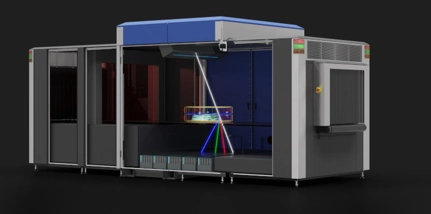

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more