18 March 2015

| Headline* | Statutory | |||||

|---|---|---|---|---|---|---|

| 2015 £m |

2014 £m |

Reported | Underlying# | 2015 £m |

2014 £m |

|

| Revenue | 1,416 | 1,442 | (2)% | 1% | 1,416 | 1,442 |

| Operating profit | 232 | 245 | (5)% | (3)% | 164 | 170 |

| Operating margin | 16.4% | 17.0% | (60) bps | – | 11.6% | 11.8% |

| Pre-tax profit | 208 | 215 | (3)% | 0% | 131 | 132 |

| Basic EPS | 38.5p | 39.5p | (3)% | 21.8p | 23.7p | |

| Free cash-flow | 58 | 30 | ||||

| Dividend | 13.00p | 12.75p | 2% | 13.00p | 12.75p | |

| Return on capital employed | 15.4% | 16.6% | (120) bps | |||

*In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Headline profit is before exceptional items, impairment of goodwill and amortisation of acquired intangible assets, pension charges and financing gains/losses from currency hedging. Free cash-flow and return on capital employed are described in the Financial review.

#Organic growth adjusting for foreign exchange translation.

Highlights

- Underlying revenue growth driven by Smiths Medical, Flex-Tek and John Crane

- Strong growth at Smiths Medical reflecting recent investment in infusion pumps

- John Crane delivered a resilient performance reflecting aftermarket strength

- Performance at Smiths Detection starting to stabilise as a result of initiatives

- Smiths Interconnect faces tough trading conditions; Flex-Tek performed well

- Headline operating margin lower with pressure in Detection and Interconnect

- Strong headline operating cash conversion at 88%; dividend up 2%

“Smiths Group delivered underlying revenue growth. Improvements at Smiths Medical, John Crane and Flex-Tek more than offset revenue declines at Smiths Detection and Smiths Interconnect where tough trading conditions persist. The reported results were held back by adverse foreign exchange.

“We remain focused on repositioning the business to accelerate medium-term revenue growth and have launched a new cross-divisional programme to add further momentum. ‘Engineered for Growth’ has four workstreams: sales and marketing effectiveness; bringing new products to market faster through innovation; quality improvement; and increasing our presence in China. Our growth investment is funded by ongoing operational improvements and our ‘Fuel for Growth’ programme, which is on track to generate £60m of annual savings by 2017.

“We expect to deliver improved underlying performance in the second half. Smiths Detection will benefit from a prior year comparator affected by one-off charges. John Crane is expected to see a slight easing in trading as upstream customers adjust their expenditure to the lower oil price and as some projects may be deferred. The growth rate at Smiths Medical will slow versus the strong first half performance. Seasonality will bias performance at Smiths Interconnect to the second half but trading in the second half will remain below last year’s levels. Flex-Tek should continue to perform well. We are focused on investing to drive sales growth in what are attractive long-term markets, and on delivering further operational improvements, while generating strong cash conversion and returns”

Philip Bowman

Chief Executive

Divisional highlights*

| Headline operating profit margin* | Headline return on capital employed* | ||||||

|---|---|---|---|---|---|---|---|

| % of Group revenue | Underlying revenue growth* | Underlying headline operating profit growth* | 2015 | 2014 | 2015 | 2014 | |

| John Crane | 32% | 1% | 0% | 23.2% | 23.2% | 26.5% | 26.5% |

| Smiths Medical | 29% | 6% | 9% | 19.0% | 18.3% | 15.1% | 15.3% |

| Smiths Detection | 16% | (5)% | (15)% | 10.3% | 11.8% | 3.1% | 8.6% |

| Smiths Interconnect | 14% | (6)% | (33)% | 9.2% | 13.1% | 12.0% | 12.2% |

| Flex-Tek | 9% | 4% | 3% | 18.1% | 18.3% | 33.7% | 32.7% |

| Group | 100% | 1% | (3)% | 16.4% | 17.0% | 15.4% | 16.6% |

*All figures are on a headline basis. Revenue and profit growth are at constant currency and exclude the impact of acquisitions and disposals.

John Crane

- Resilient performance with revenue up 1% driven by its focus on aftermarket services for rotating equipment

- Margins maintained at 23.2%; manufacturing constraints have now been addressed

- Current order book is solid, but project delays are possible in the current environment

- Tougher market conditions in upstream and first fit OEM signal a slight decline in trading for the full year

Smiths Medical

- Revenue up 6% due to strong ambulatory infusion performance and recovery in disposables

- Margins up 70 bps, reflecting higher volumes and efficiencies

- Full year performance is expected to moderate more in line with the market

Smiths Detection

- Revenue down 5% amid continued tough trading conditions; making progress on stabilising operations

- Margins down 150 bps with lower volumes and adverse pricing masking the benefit of efficiency gains

- Full year revenue is expected to be lower than last year; margins should improve against a weak comparator

- Recent order wins have strengthened order book for delivery in FY16

Smiths Interconnect

- Revenue 6% lower with pressures in Microwave and Connectors offsetting growth in Power

- Margins down 390 basis points on lower volumes, adverse operational gearing and mix

- We expect that seasonality will bias performance to the second half but will remain below prior year levels

Flex-Tek

- Revenue up 4% driven by US residential construction, specialty heating elements and aero/automotive hoses

- Margins down 20 bps with increased investment in marketing and new product development

- US construction and heating demand should support growth; margin outlook stable despite increased investment

To view the full press release please click here

Contact details

Investor enquiries

Peter Durman, Smiths Group

+44 (0)20 7808 5535

+44 (0)7825 145336

peter.durman@smiths.com

Media enquiries

Colin McSeveny, Smiths Group

+44 (0)20 7808 5534

colin.mcseveny@smiths.com

Anthony Cardew, Cardew Group

+44 (0)20 7930 0777

anthony.cardew@cardewgroup.com

Presentation

The presentation slides and a live webcast of the presentation to analysts are available www.smiths.com/results at 09.00 (UK time) on Wednesday 18 March. A recording of the webcast is available later that day. A live audio broadcast of the presentation is also available by dialling (no access code required):

UK toll free: 0808 237 0062

International: +44 (0)20 3427 0662

US/Canada toll free: 1 877 841 4559

An audio replay is available for seven days on the following numbers (access PIN 654131#):

UK toll free: 0808 237 0026

International: +44 (0)20 3426 2807

US/Canada toll free: 1 866 535 8030

Photography

Original high-resolution photography and broadcast quality video is available to the media from the media contacts above or from http://www.smiths.com/images.aspx.

Statutory reporting

Statutory reporting takes account of all items excluded from headline performance. On a statutory basis, pre-tax profit from continuing operations was £131m (2014: £132m) and earnings per share were 21.8p (2014: 23.7p).

See note 3 to the interim report for the definition of headline profit measures and note 4 for an analysis of exceptional items.

This document contains certain statements that are forward-looking statements. They appear in a number of places throughout this document and include statements regarding our intentions, beliefs or current expectations and those of our officers, directors and employees concerning, amongst other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the business we operate. By their nature, these statements involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. The forward-looking statements reflect knowledge and information available at the date of preparation of this document and, unless otherwise required by applicable law, the Company undertakes no obligation to update or revise these forward-looking statements. Nothing in this document should be construed as a profit forecast. The Company and its directors accept no liability to third parties in respect of this document save as would arise under English law.

This press release contains brands that are trademarks and are registered and/or otherwise protected in accordance with applicable law.

Related articles

Smiths Group appoints Kini Pathmanathan as Head of Smiths Excellence & Sustainability

Find out more

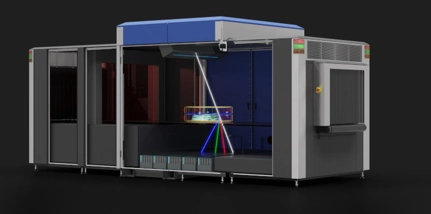

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more