21 May 2015

Expectations for the year remain in line with the outlook presented at the interim results. In the nine months to 2 May 2015, underlying revenue and headline operating profit for the Group fell slightly against the prior year. This reflects continued like-for-like revenue growth in Smiths Medical and Flex-Tek offset by declines in Smiths Detection, Smiths Interconnect and John Crane. Headline operating cash conversion was strong at 96% for the year to date.

Underlying trading at John Crane in the first nine months was slightly below the equivalent period last year as a result of difficult market conditions in some parts of the energy segment. Overall aftermarket revenues grew driven by continued demand from mid and downstream customers, despite further declines from our small upstream artificial lift business. Sales to first-fit rotating equipment customers also fell in line with our expectations. The deterioration in third quarter trading conditions resulted in a mid-single digit decline in John Crane revenue for the quarter. At constant currencies, full year revenues are expected to decline modestly. However, cost saving initiatives and favourable product mix should support operating profit margins.

Smiths Medical continued to deliver underlying revenue growth in the third quarter although, as expected, the growth rate has slowed. Underlying revenue growth in the first nine months of the year has been driven by strong demand for ambulatory infusion pumps while the vital care and safety device franchises have shown smaller gains driven by general anaesthesia and sharps safety products respectively. Headline operating profit continued to benefit from higher volumes and cost saving initiatives despite an increased headwind from transactional foreign exchange. We expect continued revenue growth in the full year results, although the growth rate will be slower than the first half.

Smiths Detection delivered underlying growth in headline operating profit in both the third quarter and year to date against a weak comparator that was affected by £12m of non-recurring charges. Despite challenging trading conditions across many markets, which resulted in lower underlying revenue for the year to date, we continue to make good progress in implementing business improvement and cost cutting initiatives. These are contributing to an improved outlook for headline operating profit margin this year and strengthening our competitive positioning. As previously guided, full year revenue is expected to be below last year. Headline operating margins are likely to improve for the year against a comparator affected by one-off costs. The order book for delivery in FY16, coupled with the benefit of our cost savings, points to an improved performance in next financial year.

Smiths Interconnect continued to face challenging trading conditions. Underlying revenue fell in the quarter, following the year to date trend, due to ongoing delays in customer spending in wireless telecoms, programme slowdowns and further softness in several markets served by Connectors and Microwave, such as defence and medical. The decline was slightly offset by growth in data centres. While we expect some improvement in trading in the fourth quarter compared with the first nine months, full year revenue and headline operating profit will remain below prior year levels.

Flex-Tek reported a sustained improvement in underlying revenue and headline operating profit. Revenue growth was driven by continued progress in Heat Solutions and Construction revenues offsetting some weakness in Flexible Solutions. The outlook for the full year remains positive and in line with previous guidance.

At 2 May, net debt was £915m, slightly reduced from the £929m at 31 January 2015.

This press release contains certain forward-looking statements with respect to the operations, performance and financial condition of the Group. By their nature, these statements involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. The forward-looking statements reflect knowledge and information available at the date of preparation of the press release and the Company undertakes no obligation to update these forward-looking statements. Nothing in this press release should be construed as a profit forecast.

Related articles

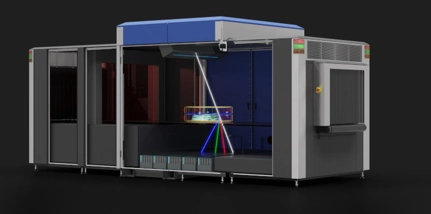

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more