21 September 2018

Return to growth

Results for the year ended 31 July 2018

| Headline1 | Statutory | |||||

|---|---|---|---|---|---|---|

| FY2018 £m |

FY2017 £m |

Reported growth | Underlying2 growth | FY2018 £m |

FY2017 £m |

|

| Revenue | 3,213 | 3,280 | (2)% | 2% | 3,213 | 3,280 |

| Operating profit | 544 | 589 | (8)% | 3% | 494 | 674 |

| Operating margin | 16.9% | 18.0% | (110)bps | 10bps | 15.4% | 20.5% |

| Pre-tax profit | 487 | 528 | (8)% | - | 435 | 601 |

| Free cash-flow | - | - | - | - | 302 | 370 |

| Return on capital employed | 14.6% | 16.2% | (160)bps | - | - | - |

| Continuing basic EPS | 90.7p | 97.6p | (7)% | 4% | 70.0p | 144.1p |

| Dividend | 44.55p | 43.25p | 3% | - | - | - |

1 In addition to statutory reporting, Smiths Group reports its continuing operations on a headline basis. Definitions of headline metrics, and information about the adjustments to statutory measures are provided in note 3 to the financial statements.

2 Underlying modifies headline performance to: adjust prior year to reflect an equivalent period of ownership for divested businesses; include restructuring and pension administration costs as headline for both years; and exclude the effects of foreign exchange, acquisitions and supplemental sales for divested businesses.

Highlights

- Return to growth with underlying2 revenue up 2% to £3,213m. Reported revenue down (2)% due to adverse foreign exchange translation

- Underlying2 headline1 operating profit up 3%. Reported headline operating profit down (8)% due to the reclassification of restructuring and pension administration costs as headline items, and adverse foreign exchange translation

- Continued focus on operational excellence with stock turns at 3.7x (FY2017: 3.5x)

- Good cash generation with cash conversion of 99% and strong balance sheet

- Continued investment for sustainable growth with R&D at 4.6% of sales (FY2017: 4.6%)

- Further progress on portfolio optimisation:

- $30m synergies from the Morpho acquisition will be delivered ahead of schedule

- Agreement to sell Smiths Medical’s sterile water bottling business for $40m

- Proposed final dividend of 30.75 pence per share. Full year dividend growth of 3%.

Andy Reynolds Smith, Group Chief Executive, commented:

“FY2018 marks an important milestone on our journey. We said that this would be the year we returned to growth, and we’ve done that. Our next objective is to deliver continued, sustainable growth, on the way to outperforming our markets.

With the exception of Smiths Medical, where the second half was disappointing, we delivered a good performance. As anticipated, our growth rate accelerated in the second half of the year driven by John Crane, Smiths Detection, Smiths Interconnect and Flex-Tek.

We continued to progress the high-grading of the portfolio through organic and inorganic investment with approximately 80% of the Group now well positioned in attractive markets. Our acquisitions of Morpho Detection, Seebach and the heating element division of Osram are being successfully integrated, with synergies being delivered ahead of schedule. The disposal of two non-core businesses in Smiths Medical and John Crane has supported our increasing focus on products and services with scalable, technology-differentiated leadership positions in our chosen markets.

We’re focused on world-class competitiveness. We delivered further stock turn improvements, now at 3.7x, and good cash conversion of 99%. This has helped to fund disciplined investment in commercially focused R&D and innovation.

In FY2019 we anticipate at least sustaining the rate of underlying revenue growth. As in previous years, Group performance in FY2019 is expected to be weighted towards the second half. Foreign exchange will provide a tailwind to reported revenue and operating profit, if current rates prevail.

Over the medium-term, we remain confident that we can grow faster than our markets. This is driven by our strategy to focus the portfolio for growth and deliver world-class competitiveness, underpinned by our strong financial framework. In parallel with continued active portfolio management, the Board remain confident that this will drive long-term sustainable growth and attractive returns.”

Statutory reporting

Statutory reporting takes account of all items excluded from headline performance. On a statutory basis, pre-tax profit from continuing operations was £435m (FY2017: £601m) and continuing basic earnings per share were 70.0p (FY2017: 144.1p).

See accounting policies for an explanation of the presentation of results and note 3 to the accounts in the full press release for an analysis of non-headline items.

Contact details

Investor enquiries

Jemma Spalton, Smiths Group

+44 (0)20 7004 1637

+44 (0)78 6739 0350

jemma.spalton@smiths.com

Marion Le Bot, Smiths Group

+44 (0)20 7004 1672

+44 (0)75 8315 4386

marion.lebot@smiths.com

Media enquiries

Deborah Scott, FTI Consulting

+44 (0)203 727 1459

+44 (0)797 953 7449

smiths@fticonsulting.com

Alex Le May, FTI Consulting

+44 (0)203 727 1308

+44 (0)770 244 3312

smiths@fticonsulting.com

Legal Entity Identifier (LEI): 213800MJL6IPZS3ASA11

Presentation

The presentation slides and a live webcast of the analyst presentation will be available at www.smiths.com/investors at 09.00 (UK time) today. A recording of the webcast will be made available from 13.00 (UK time).

Photography

Original high-resolution photography is available to the media from the media contacts above or from http://www.smiths-images.com.

This document contains certain statements that are forward-looking statements. They appear in a number of places throughout this document and include statements regarding the intentions, beliefs and/or current expectations of Smiths Group plc (the “Company”) and its subsidiaries (together, the “Group”) and those of their respective officers, directors and employees concerning, amongst other things, the results of operations, financial condition, liquidity, prospects, growth, strategies and the businesses operated by the Group. By their nature, these statements involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. The forward-looking statements reflect knowledge and information available at the date of preparation of this document and, unless otherwise required by applicable law, the Company undertakes no obligation to update or revise these forward-looking statements. Nothing in this document should be construed as a profit forecast. The Company and its directors accept no liability to third parties. This presentation contains brands that are trademarks and are registered and/or otherwise protected in accordance with applicable law.

Related articles

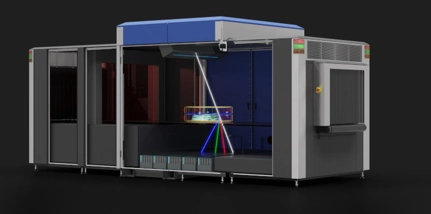

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more

Smiths Group plc share buyback programme

Find out more

Half year results for 6 months ended 31 January 2024

Find out more