24 April 2015

Smiths Group plc confirms the launch and pricing yesterday of a EUR600 million senior bond offering (“the Notes”) for general corporate funding purposes and to repay certain existing debt.

The Notes, priced with a fixed coupon of 1.25%, will have a maturity in April 2023 and the offer is expected to close on 28 April 2015. The Notes will be issued by Smiths Group plc, guaranteed by Smiths Group International Holdings Limited, and will rank pari passu with all its other existing unsecured indebtedness.

Finance Director Peter Turner said: “This bond issue is a successful refinancing exercise for the group, extending maturity profiles and reinforcing the stability of our balance sheet and financing profile over the long term.”

Related articles

Smiths Group appoints Kini Pathmanathan as Head of Smiths Excellence & Sustainability

Find out more

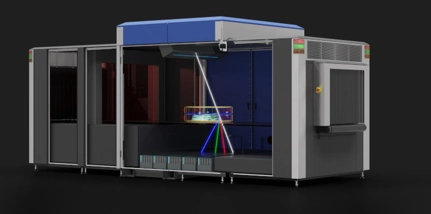

Smiths Detection to supply Belfast International Airport with 3D X-ray scanners

Find out more

Smiths Detection launches X-ray Diffraction technology to combat illegal narcotics and contraband trafficking

Find out more