A fundamentally strong business

Smiths is a FTSE 100 company with a balanced portfolio of market-leading, industrial technology businesses. Our businesses have leading positions in critical markets, and deliver superior customer service through our global capabilities and sustained investment in R&D.

All of this supported by a robust financial framework with high proportion of recurring revenues through our aftermarket offering, and high and resilient margins.

Supporting a premium rating for Smiths

Building on our strong operational and financial performance, we are pursuing a number of strategic actions to unlock significant value and enhance returns to shareholders:

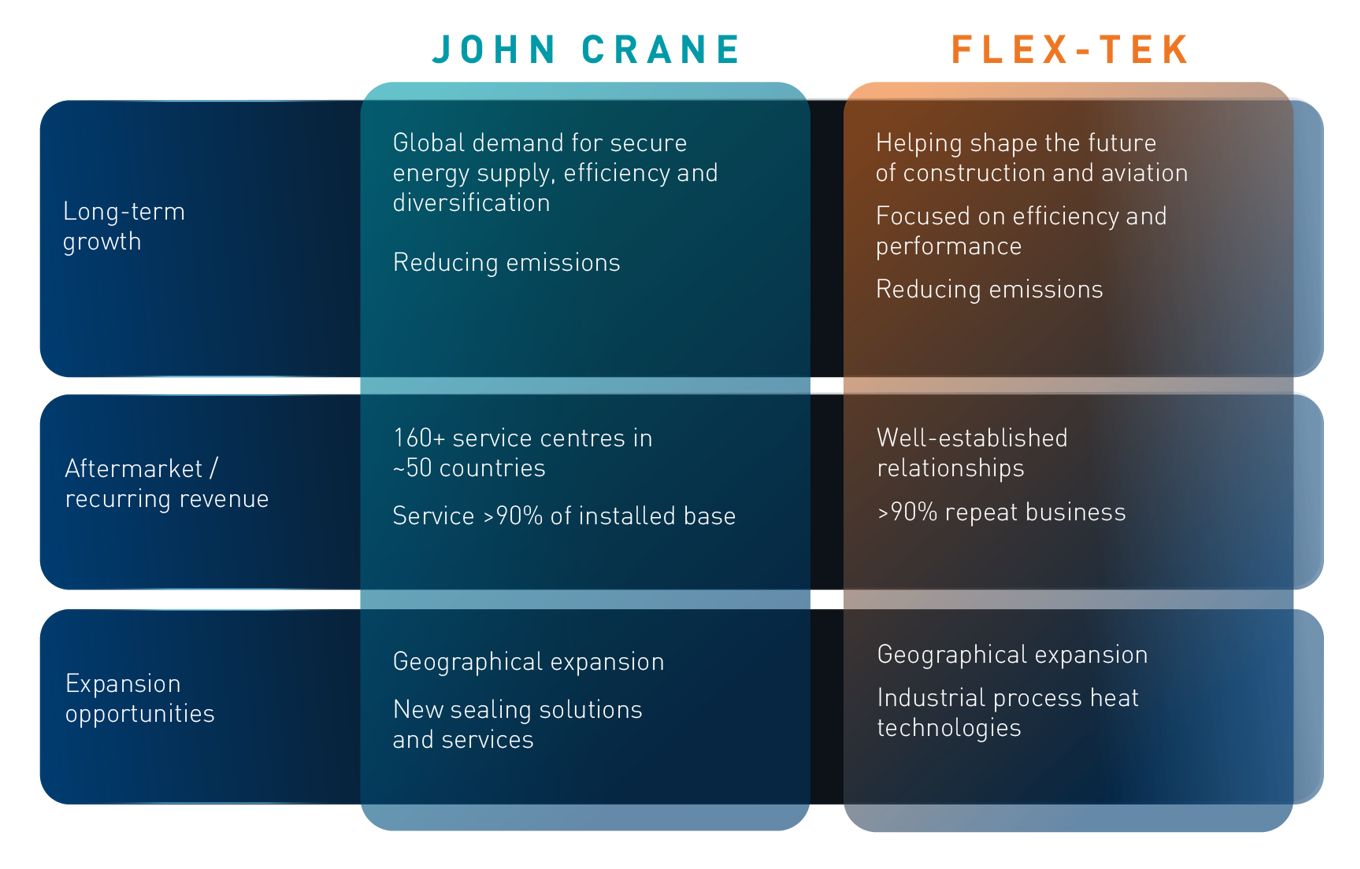

- We are focussing on our world-class John Crane and Flex-Tek businesses

- We are divesting Smiths Interconnect and announced in September 2025 that we have entered into an agreement for the sale of Smiths Interconnect to Molex Electronic Technologies Holdings

- Smiths Detection is to be separated either by UK demerger or sale

- We will return a large portion of the disposal proceeds to shareholders

We are becoming a focused business with significant potential for future growth and value creation. Focusing on our world-class John Crane and Flex-Tek businesses and carefully managing the separation of Smiths Interconnect and Smiths Detection, we will deliver significant value for all stakeholders.

Significant potential for growth and value creation

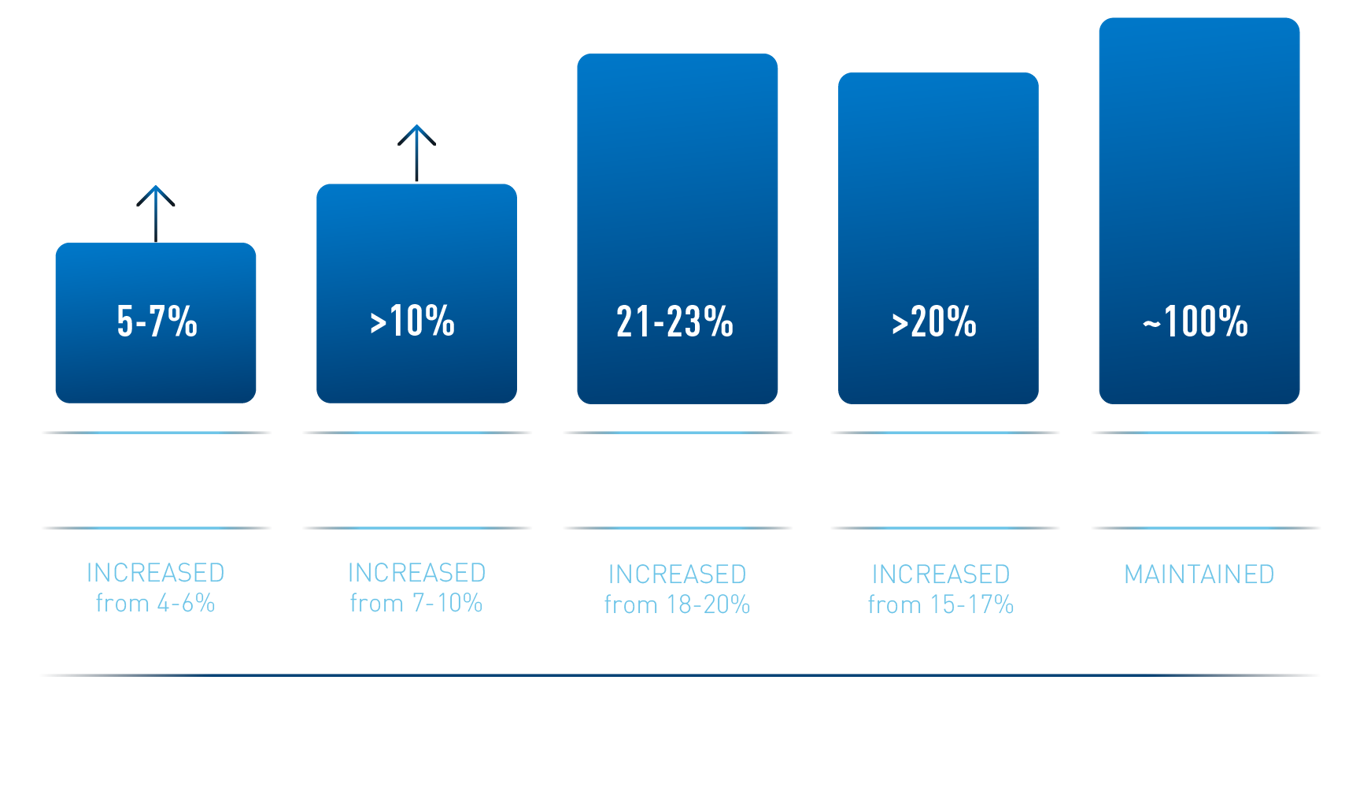

Enhanced medium term targets - reflecting further growth and higher return potential

A strong performance in FY2025

Organic revenue growth

Headline operating profit margin (+60bps)

ROCE (+170bps)

Headline EPS growth

Headline operating cash conversion (+2pps)

Total shareholder return