Supporting a premium rating for Smiths

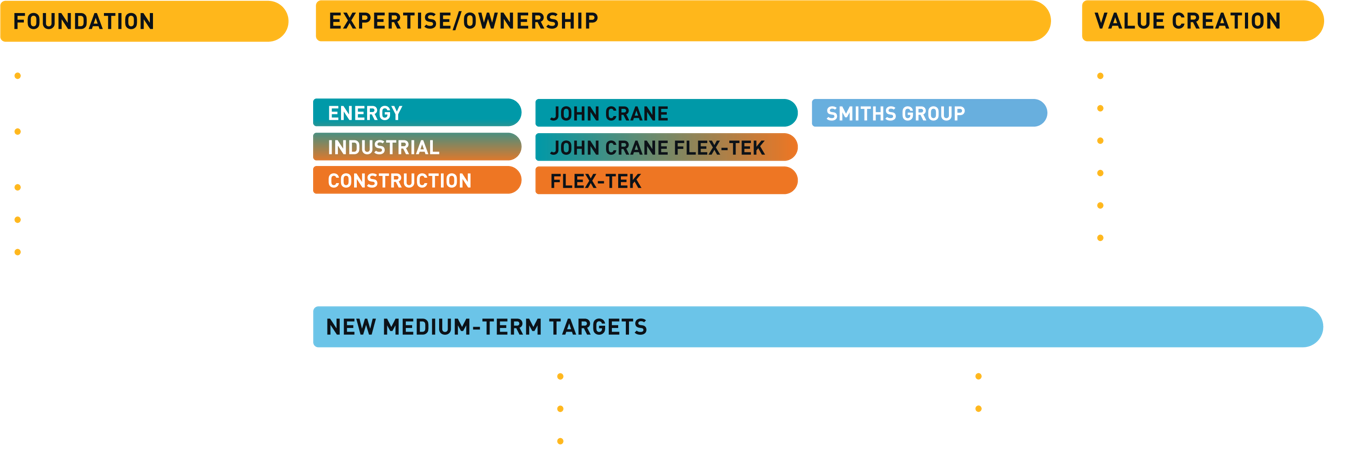

Building on our strong operational and financial performance, we are pursuing a number of strategic actions to unlock significant value and enhance returns to shareholders:

- We are focussing on our world-class John Crane and Flex-Tek businesses

- We are divesting Smiths Interconnect and announced in September 2025 that we have entered into an agreement for the sale of Smiths Interconnect to Molex Electronic Technologies Holdings

- Smiths Detection is to be separated either by UK demerger or sale

- We will return a large portion of the disposal proceeds to shareholders

Watch our full year results video where our CEO and CFO discuss the separation process and future of Smiths, including our new, enhanced financial targets that support a premium rating for Smiths.

Read latest news related to our strategic actions

Smiths Group plc sale of Smiths Interconnect

Read more

Our strategy and business model

When we have completed these strategic actions we will be a focused industrial engineering company specialising in high performance technologies for flow management and thermal solutions.

End Markets

Our businesses operate in attractive, growing end markets aligned with positive structural megatrends: