5 July 2013

Smiths Group plc and the Trustees of its two major UK pension schemes – Smiths Industries Pension Scheme (SIPS) and the TI Group Pension Scheme (TIGPS) – have agreed to maintain the current annual contributions over slightly reduced recovery periods.

These agreements follow completion of the triennial actuarial valuations of the schemes at 31 March 2012 and 5 April 2012 respectively which showed deficits of £535m in SIPS and £117m in TIGPS at those dates. These deficits reflect depressed discount rates, which have been affected by the impact of quantitative easing.

The current contributions to the plans will continue as follows:

- Cash contributions to SIPS of £36m a year until October 2019.

- An on-going annual investment of £24m a year in index-linked gilts which will be held in an escrow account in connection with SIPS. The escrow account will remain a Company asset until 2020 subject to the funding position at that time or may revert to the Company sooner should there be a surplus at an intervening triennial review. This provides a contingent funding commitment to SIPS without locking the investment into the Scheme should its funding position improve.

- Cash contributions to TIGPS of £16m a year until April 2016.

These funding plans will be assessed at future triennial reviews and allow for contributions to be reduced in the event of improvements in the overall funding positions of the Schemes at future triennial valuations.

The Group has already taken a number of measures in recent years to reduce its exposure to post-retirement liabilities, including closing the defined benefit pension plans in the UK and US and capping its obligations for post-retirement healthcare benefits.

Notes:

The actuarial valuations for the two schemes at the last triennial review were as follows: £545m for SIPS at 31 March 2009 and £110m for TIGPS at 5 April 2009.

Pension scheme membership at the end of January 2013:

| Pension scheme membership | SIPS | TIGPS | US plans | Total |

|---|---|---|---|---|

| Deferred active | 560 | 290 | 3,500 | 4,350 |

| Deferred | 12,110 | 14,550 | 6,710 | 33,370 |

| Pensioners | 12,990 | 18,350 | 5,400 | 36,740 |

| Total | 25,660 | 33,190 | 15,610 | 74,460 |

Smiths Group also operates a defined benefit pension plan in the US and other small schemes elsewhere. Current contributions to these other plans total approximately £35m a year.

General media enquiries

Contact our global media and communications team at:

Please note – the press team can only answer enquiries from accredited members of the press.

Related articles

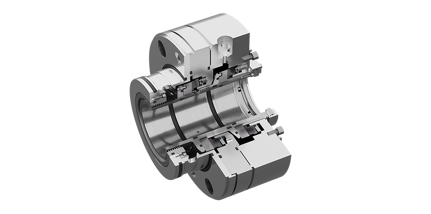

John Crane unveils game-changing mechanical seal, setting new benchmark for ethane pipeline performance

Read our company news as John Crane has launched a new mechanical seal

Find out more

![Davinci Gen V Banner Iamge[39]](/media/whpf0qko/davinci-gen-v-banner-iamge-39.jpg?width=431&height=214&format=webp&quality=100&v=1dbb81c2443a690)

Smiths Interconnect announces significant contract win

Read our company news as Smiths Interconnect announces a significant contract win

Find out more

Smiths Interconnect welcomes new EU-Canada security and defence partnership

Find out more